GLOBAL ECONOMICS

GLOBAL ECONOMICS COMMENTARIES

Patrick Grady

“Longer Term Industrial Structure: So What?”

A Paper Based on a Presentation to the CABE Moneco-Econtro Summer Conference

August 24-25, 2009

Why Worry About Industrial Structure?

The central question I’d like to raise following up on Mike McCracken’s presentation on “Longer Term Industrial Structure Issues,” and its projections of industrial output to 2030 is: “Why worry about industrial structure?” And as a corollary: “What can we do about it?”

The Longer Term Industrial Projections

But before turning to my questions, there are a few things that need to be said about the projections. First, they certainly provide a good starting point for our discussions. They are built on a plausible set of assumptions on the key domestic and external factors including the demographics and the external environment. And thus they provide a reasonable and consistent basis for considering the evolution of Canada’s industrial structrue.

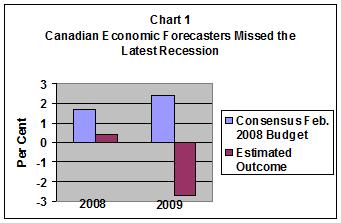

But it is also important to bear in mind that forecasting is not a precise science and that projections have recently not been very reliable even in the short run. When private sector forecasters were surveyed before the February 2008 budget, the average of their forecasts for GDP growth in 2009 was for growth of 2.4 per cent (Chart 1). As it now seems likely, this is approximately the right magnitude but exactly the wrong sign. As a profession, we thus need to ask ourselves, how can we possibly hope to accurately forecast aggregate output 20 years in the future, if we can’t even get GDP right a year or so out? This, of course, is a general point applicable to all longer term forecasts and should not be taken as a specific criticism of the Informetrica projections.

Forecasters currently face larger risks than usual. At the macro level, the biggest risk facing the economy is the huge imbalances that have been exacerbated by the policy response to the financial crisis. The key problem for policy makers will be withdrawing the enormous fiscal and monetary stimulus without precipitating another recession (the “exit strategy”). If done too fast, aggregate demand will drop. If too slow, inflation will pick up and bring on a round of monetary tightening.

Another risk going out so far is the impact of climate change on Canada and the global economy. If there is any truth to the global warming hypothesis, a garden variety business-as-usual growth projection is not going to be very helpful to policy makers.

This suggests that it would be most useful if longer term projections were to include alternative scenarios to show the full range of possible outcomes for the economy.

And then there is the additional problem of projecting the industrial detail. This is made more difficult by the likely development of unanticipated new products and new industries like software and information technology that in the past have contributed disproportionately to the growth of Canadian industrial output. For instance, how likely is it that a 20-year industrial projection done in the United States in 1980 would have anticipated the computer and information technology revolution.

But recognizing that our crystal balls are more than usually cloudy at the moment, there are still important things that we can learn from long-term projections such as those presented.

Canada has been clobbered by arguably the worst global recession of the postwar period. It has hit the resource-based and cyclically sensitive industries the hardest. The recovery will necessarily entail further structural adjustment that will impact on most industries. The projections suggest that the resource and cyclically-sensitive sectors, which are hardest hit by the recession, will bounce back. However, they also predict that the decline in Canada’s manufacturing sector from 17 per cent of output to 12 per cent will be largely maintained.

So Which Industrial Structure is Best?

The key question is: What does this prospect for industrial structure mean? More specifically, which industrial structure is best for growth in incomes and living standards and produces the good jobs sought by Canadians?

My answer is that no particular industrial structure is intrinsically the best, but that it depends on what works best for the individual economy and the material and human resources at its disposal. On the other hand, it is still important to recognize that there are definite limits to the extent that a country can prosper without exporting, which by its nature usually means mostly goods.

There has been much debate about the most appropriate industrial structure – the relative merits of resources vs.manufacturing vs. services. And there are still a few people around that believe that an industrial policy is what is needed to shape the country’s economic. The free market has also taken a bad rap in the aftermath of the financial crisis which has emboldened those calling for a more interventionist approach to economic policy and regulation.

But I still am among those who believe that the most powerful engine of economic growth and development is the free market. The financial crisis does not spell the end of the free-market policies espoused by Reagan and Thatcher. Price signals can still best direct labour and capital to where they can be most profitably employed. Labour and capital should be free to move unimpeded across provincial and international borders to take full advantage of the best opportunities. The rates of return can still guide capital to most productive investments. And they should not be distorted by taxes. The cost of capital should be the same for all users of capital across the country. It is also vital that capital markets function as well as possible.

The Production Function

The best theoretical framework for a consideration of longer term growth prospects, which underlies our subsequent discussion, is the theory of production. The most commonly used production function is the Cobb-Douglas, which is as follows:

Q=A*La Kß,

where:

Q = total production (the real value of goods produced),

L = labour input,

K = capital input,

A = total factor productivity, and

a and ß are the output elasticities of labour and capital, respectively, considered to be constants determined by available technology.

What Can We Do to Achieve a Strong Industrial Structure in the Longer Term?

First, since Canada is a trading nation, we must have a favourable external environment, which unfortunately is beyond our control. But there is something we can do. Specifically, we need to get two policy areas right:

- A stable macroeconomic framework. This means we need to eliminate the deficit after the stimulus package is spent. For this, there is bipartisan support. Everyone recognizes that the $50 billion deficit this year is not sustainable. But it will be very tricky to withdaw budget and financial support provided by the Government and the Bank of Canada without undercutting growth.

- Microeconomic or structural policies.

There are also other important policies such as social policies and income distribution policies that need to be right to not undermine longer term growth.

Some Thoughts on Structural (or Microeconomic) Policies

Longer term industrial policies are those that are most relevant for longer term industrial structure. Let’s consider some of the most important.

Trade

As a medium-sized open economy, Canada is dependent on trade for its prosperity. And with globalization and rise of the BRIC countries, the international environment is becoming increasingly competitive. But the agreements that establish the rules governing our trade with the rest of the world are not working as well as in the past. The WTO has become less functional. It is not necessarily able to resolve trade disputes decisively. The Doha Round of Multilateral Trade Negotiations has been “suspended indefinitely.” The NAFTA has also not been working like it used to. Exports to the United States have stagnated because of the “thickening” of the border after September 11, 2001. And this year “Buy American” has arisen as another threat to Canadian exports. There are also a number of trade disputes like the country of-origen-labelling (COOL) on beef and swine before the WTO and NAFTA chapter 11 and 19 disputes like Glamis. Another potential issue is the June $1-billion package for the forest industry designed to rescue pulp producers from U.S. subsidies including $8-billion (U.S.) in “black liquor” subsidies. There is a real risk that this support could revive dormant softwood lumber dispute and provoke retaliatory action from the United States.

It goes without saying that Canada would benefit from a barrier-free internal market. There has been progress in improving internal trade. The B.C.-Alberta Trade and Labour Mobility Agreement has served as a catalyst to reinvigorate the Agreement on Internal Trade and negotiations were launched to strengthen the agreement. But two provinces still haven’t signed on the new labour mobility agreement that was supposed to be in effect last January, and three are reportedly seeking exemptions. The longstanding dispute over whether CGA should be allowed to audit also still hasn’t been fully resolved in Ontario.

To achieve satisfactory long term growth of its industries, Canada has to be open to the world and to have a dependable rules-based trading system. It also needs a well-functioning internal market.

Taxation

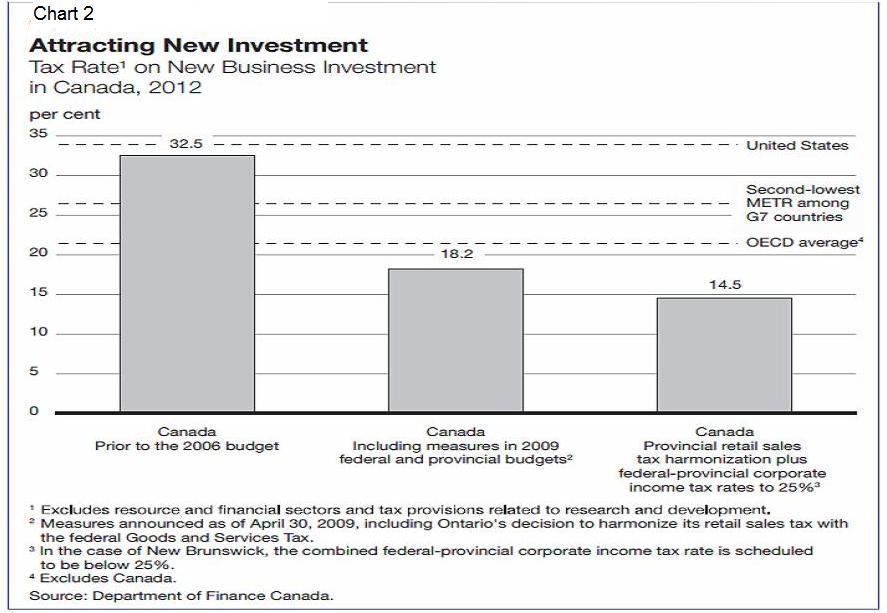

A favourable tax environment is also key to the growth of Canadian industry. And important steps have been taken. The general corporate income tax rate has been lowered from 22.12 per cent (including the corporate surtax) in 2007 to 15 per cent by 2012. This will give Canada the lowest statutory tax rate in the G7 by 2012, and the lowest overall tax rate on new business investment by 2010. Moreover, there is bipartisan agreement between the Conservative Government and the Liberal Opposition on need to have lower corporate tax rate than the U.S. (i.e. 25 per cent vs. 35 per cent).

Another key feature of corporate tax changes in recent years is that they have resulted in a reduction in differentials among sectors and a move towards a more neutral tax system. This allows market forces unimpeded by tax considerations to have a greater role in the determination of industrial structure.

Also of benefit to industrial investment are two other recent tax developments. The Federal Government’s has eliminated its capital taxes and has encouraged the provinces to do likewise. In addition, Ontario and British Columbia have agreed to harmonize their sales tax systems with the GST. The Godsoe Advisory Panel on International Taxation has also made some further good recommendations for improving our tax system that warrant consideration.

Our tax system is thus very competitive. In fact, it is now the lowest on new business investment of the G7 and below the OECD average (Chart 2). Canada is being branded as a low tax jurisdiction. This follows the Irish model of encouraging industrial development, which was so successful before the current recession.

Finance

To prevent a financial collapse, $115 billion in extraordinary financial support has been provided by the Government and the Bank of Canada. The issue is how to withdraw it without undercutting the ability of firms to finance growth.

Capital markets must function well to provide the capital required for growth. This requires that they be well regulated. The Hockin report has again underlined the need for a single security regulator – a Canadian Securities Commission. This would reduce the costs of fees and compliance for Canadian security issuers and increase the availability of capital and lower its cost. It would also strengthen the financial system. Recent examples where the lack of a single regulator has presented difficulties for Canadian authorities are: in following the U.S. short selling ban in September 2008; and in quickly developing a policy paper after the Asset Based Commercial Paper Market (ABCP) was frozen in August 2007.

Competition and Innovation Policy

The Wilson report – Compete to Win – provided a very thorough discussion of competition and innovation policy that offered many constructive suggestions for Canada. It is a roadmap for sound structural policies in this and many other areas. R&D

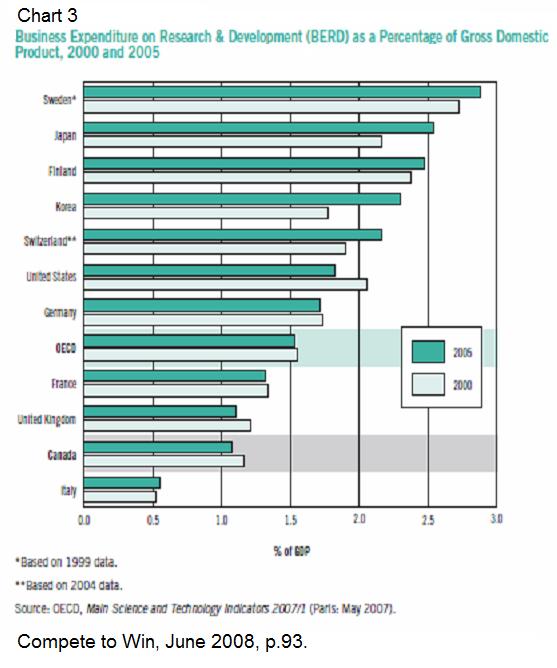

Canada’s scientific research and experimental development (SR&ED) tax incentive program is one of the most generous in the industrialized world for supporting business investment in research and development (R&D), It provided over $4 billion in tax assistance in 2007 and was enriched in the 2008 budget. Currently, it is 35 per cent refundable for first $2 million of qualified SR&Ed expenditures for Canadian Controlled Private Corporations (CCPCs) and 20 per cent non-refundable for other corporations. At first glance, this would seem more than adequate.

However, there is still the conundrum of why Canadian business expenditure on R&D is so low compared to most other major industrialized countries (Chart 3). Some argue that this is because Canada is able to benefit from R&D done elsewhere either through inter-firm sharing of technology or outright purchase. But there remains a general feeling among many including the Wilson Committee that Canada needs to do better if we are to compete internationally.

Infrastructure

Infrastructure is needed to support economic growth. This includes: roads, bridges, other transportation facilties, communication, municipal infrastructure like water and sewage, and electricity and other utilities. Much of this infrastructure is provided directly by governments. Some is provided by the private sector often with support from governments.

There has been a lively debate in literature on the contribution that infrastructure makes to economic growth. Some even treat infrastructure a separate factor in the production function (Aschauer, 1989). It was started by and surveyed by Gramlich (1994) and World Bank (1994). Over the years, Mike McCracken has also contributed. And now we have the presentation by Baldwin and Macdonald (2009).

And common sense also suggests that infrastructure is necessary for growth and that the government has a certain responsibility for either providing or making sure that the appropriate infrastructure is in place. There is a real concern that an infrastructure deficit exists and that the capacity of our infrastructure could become a drag on growth. Traffic congestion in our major cities and delays at the border are current problems resulting from inadequate infrastructure. In the future, shortages of electrical generating capacity could become a problem because constraints on the development of new capacity resulting from concerns over Green House Gas (GHG) emissions and nuclear-phobia.

The Federal Government began seriously to address the infrastructure deficit with its $33 billion Building Canada Plan over 2007-14. And now to accelerate the process, Canada’s Economic Action Plan has allocated close to $12 billion in infrastructure funding over this and the next year as a stimulus measure.

Immigration

Immigration can contribute to Canada’s long term growth by providing the skilled labour the economy needs. But for everyone to benefit, per-capita income must increase. This means that the immigrants must be able to earn more than the Canadian average after a certain transition period. Otherwise due to our social welfare transfer system, Canadian taxpayers will have to bear an increasing tax burden and find their after tax incomes reduced from what they would otherwise be. Recent cohorts of immigrants have been earning substantially less than the Canadian-born so immigration is currently not working as intended.

Education and Training

Most of our needs for an educated and skilled labour force will be met from our own education and training system, and not from immigration. Thus, it is critically important that it be world-class and meet the needs of our labour market. Educated people are the source of the innovation that drives economic growth.

Environmental Policy

Environmental policy also has an important impact on industrial structure. If GHG emissions are leading to global warming, this will have significant, and probably unavoidable, implications for Canada’s future economic development. While there still are climate sceptics who question the relationship between GHG and global warming, regardless of our view on climate change, it should be obvious that Canada will have to follow U.S. if it introduces measures to reduce GHG emissions like “cap and trade,” which has been passed in the U.S. House of Representives. Otherwise Canada would end up likely being penalized. Cap and trade will thus, if implemented, affect our industrial structure dramatically. Industries like oil sands and petrochemicals that are large producers of GHG will be smaller than otherwise as a result and contribute less to growth. Other products that use carbon produced energy could also be disadvantaged relative to the products of emerging countries like China and India that do not impose restrictions. On the other hand, goods and services to improve environment are a potential export and source of jobs. But this offset could prove disappointingly small.

Energy

Energy is Canada’s strong suit and should become increasingly important in production if it is not too penalized by carbon restrictions. But the expansion of this sector will put upward pressure on the Canadian dollar that would make other Canadian producers less competitive. Canada could easily develop a bad case of the Dutch disease that would undercut our manufacturing industries.

On the other hand, measures could be adopted in the United States that discriminate against Canadian oil sands production. Several states (including California and Minnesota) have taken or are contemplating actions against dirty oil from the tar sands, which is the main source of Canada’s potential increased energy production.

Foreign Investment

Foreign investment can serve as an important engine of economic growth. But it also gives rise to concerns particularly if it involves foreign takeovers of venerable domestic producers. Stelco and the steel industry are cases in point. However, in this particular case, it is easy to dismiss these concerns if account is taken of the potential benefits of increased integration of the North American industry.

Nevertheless, there still are legitimate questions raised by two other high-profile events involving foreign investors. Falconbridge was taken over by Xstrata in 2006 after a contested take-over battle with Inco, which in turn was taken over by CVRD of Brazil. Competition policy, which had a role in preventing the Inco-Falconbridge merger, seems to be contributing to the demise of what had been a world-leading Canadian mining industry.

Another important event is the sale of Nortel assets. RIM, Canada’s leading high tech company, has been complaining vociferously that it has unfairly been barred from bidding on certain Nortel wireless technology assets (LTE and CDMA) that Telefon AB LM Ericsson had acquired for a winning bid of $1.1 billion in the bankruptcy proceedings. The appropriateness of the auction could be addressed as part of a review under the “national interest test” of the Investment Canada Act. However, there is a question if such a review will ever take place as the book value of assets is only $149 million, which falls under $312 million threshold for review in the act. RIM’s case certainly seems to deserve a hearing. Why isn’t the Government giving it a fair shot at assets developed with much Canadian taxpayer support?

There are other issues relating to Investment Canada. While private foreign investors should be treated the same other domestic investors, it should be recognized that state investors are different than private. They are motivated by non-economic factors and by their national interests. So their actions do not always meet the market test and lead to the best use of the assets purchased. The Investment Canada Act maybe needs to be reviewed to make sure it applies the “national interest test” to state investors with more critical scrutiny to identify potential situations where national interests will clash.

Old Fashioned Industrial Policy

The Government should not seek to pick winners and losers. When it has tried, it has generally failed. Canadian history is littered with government subsidized firms that have failed. The current problem though is not so much the Government trying to pick the winners, as the losers picking the Government.

The Federal and Ontario governments have invested more than $15 billion bailing out GM and Chrysler. The U.S. Government should have let the firms go bankrupt without getting involved. But it didn’t. And unfortunately, this left Canada with little choice. It either had to pony up its share or be left out of the restructuring of North American automobile industry. And, of course, politically the Government couldn’t allow itself to appear to be indifferent to the fate of workers.

Mike McCracken apparently thinks that the restructuring of the North American automobile will be successful. He projects that output in the motor vehicles and parts industry will bounce back strongly over the 2010-13 period. Personally, I would be surprised if the automobile recovers as briskly and if Government’s investment in the automobile industry ever pays off. But we’ll have to wait and see.

The Government’s eagerness to bail out the automobile industry contrasts sharply with its hard-nosed approach in refusing aid to Nortel. The Government was willing to let the former crown jewel of Canada’s high tech sector go bankrupt without urgent efforts to prepare a financial rescue package. And it didn’t seem to matter that Nortel was Canada’s biggest investor in R&D. Will the auto sector turn out to be a better investment than telecommunications? I wouldn’t bet on it.

Conclusions

Canada’s Long Term Industrial Structure is not something that can be forecast with much confidence. At best, projections can suggest that we are likely to have continuation of the recent low share of manufacturing and a rising resource share at the highest level of industrial aggregation. As to the specifics of the industrial composition of output, it really does not matter that much. What really counts is that some industries grow enough to generate a high and growing standard of living for Canadians.

The best strategy for the Government is not to try to pick winners and losers among industries, but to set in place a broad framework of macroeconomic and microeconomic (or structural) policies that will be most conducive to longer term economic growth. This means monetary and fiscal policies consistent with non-inflationary (or low-inflationary) growth and structural policies designed to make Canada an open, low-tax, competitive and innovative economy along the lines proposed above. And in no cases should specific Government interventions be made or restrictions imposed that disadvantage particular Canadian companies. The Government should allow the free market to function. It is still the best mechanism for determining resource allocation and the resulting industrial structure.

References

Advisory Panel on Canada’s System of International Taxation (2008) Final Report: Enhancing Canada’s Tax Advantage, December.

Aschauer, David A. (1989) ‘Is Public Expenditure Productive?’, Journal of Monetary Economics, 23(2), pp.171-188.

Baldwin, John and Ryan Macdonald (2009) “Infrastructure Investment in Canada,” Statistics Canada. Canada (2009) Canada’s Economic Action Plan: a Second Report to Canadians, June.

Competition Policy Review Panel (2008) Compete to Win: Final Report, June.

Expert Panel on Securities Regulation (2009) Creating an Advantage in Global Capital Markets: Final Report and Recommendations, January.

Gramlich, Edward M. (1994) “Infrastructure Investment: A Review Essay,” Journal of Economic Literature, 32, pp.1176-1196.

McCracken, Mike (2009) Longer Term Industrial Structure Issues,” Moneco-Econtro Summer Conference, August 25.

World Bank (1994) World Development Report – Infrastructure and Development, Washington, D.C., Oxford, Oxford University Press.